EM Thoughts. Brazil Payments Industry : Where Everyone is a Winner?

Brazil Payments Review

The Brazilian payments sector has been a favourite of global growth investors, enabling corporates to scoop up billions of dollars from enthusiastic investors and rewarding them with ever increasing stock prices. Merchant acquirers such as PagSeguro and Stone are staples in growth portfolios, and companies in the adjacent E-commerce sector such as Mercado Libre are rushing into offline merchant acquiring and even the largest global acquirer, the newly formed FIS Worldpay talks enthusiastically about making a foray into Brazil to do merchant acquisition and SME lending.

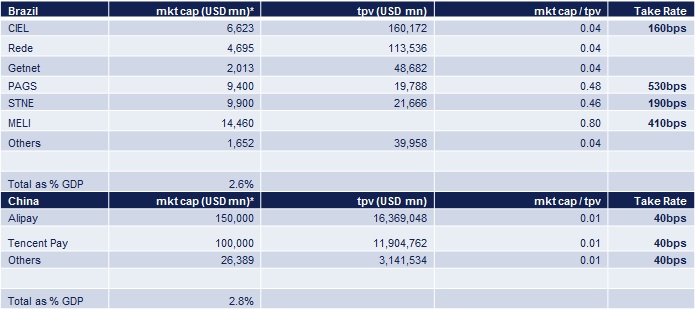

To understand what is currently implied in the valuations of the sector in Brazil, let’s make a rough and ready comparison to China, where you have a payments business dominated by two players, Ant Financial and Tencent Pay, that are years ahead in terms of rolling out their business models and closing the loop in payments. Why should the Brazilian market be over-earning relative to the Chinese market to such a degree?

*We have assumed 60% of Meli’s value is derived from its payments business, similarly we have taken an average implied payments business valuation for Alipay and Tencent Pay

Source: ABECS, Company reports. Tpv = total payments volume. Take rate = percentage share from transactions that the company derives

Having lived through a few feeding frenzies of similar nature, we reminisced about the capital markets story of erstwhile structural growth industries in Brazil such as homebuilders or education. The pattern is familiar. The strong demand for stock elicits a rapid reaction in the form of equity issues. The number of companies in the subsector multiplies and the existing companies raise cash on favourable terms to replenish their cash buffers. Sector growth, supercharged by the inflow of capital, takes wings. Companies then start to penetrate less profitable cohorts as Brazil’s vast population masks a pyramid like socio-economic structure with large economically unviable base.

Finally, the increase in the number of competitors and capital in the sector starts to eat into pricing and margins, quickly reducing the ROE of the sector. Newly public companies, hastily packaged by bankers to cater to the latest investor fashion struggle with the competitive intensity and fail their investors.

Although the payments industry shares some of the attributes of the above cautionary tale, it does have important advantages over previous bubble sectors in Brazil. Capital intensity is low and regulation does not yet play an important role. However, we thought it would be revealing to analyse whether the market is blind in its love affair with the industry. To set the stage, let us look at penetration rates.

Chart 1 : Brazilian Market is one of the most highly penetrated in the world in terms of POS machines

POS = Point of Sale machine .

Source: ABECPSPOS Base Cross Country Comparison (# of POS / k habitants)

And how pricing compares to international peers.

Source: ABECS, Bernstein

And finally where the acquirers make their profits.

MDR: Merchant Discount Rate, the rate the acquirer charges the merchant to accept card

*Before Holding costs, i.e., net revenue minus cogs and selling expenses

Source: Companies financial statements; Carrhae estimates

The above charts do not paint a rosy outlook. The challengers in the industry derive roughly two thirds of their profits from ‘factoring’ in the form of prepayment of credit card receivables, which is a very low risk form of lending. The issue is what the Brazilian payments industry charges for it.

Source: Companies’ websites.

This is an amazingly lucrative business. The question is whether it is sustainable? Who has an incentive to change this situation and do they have the power to effect change? In this case, there is an actor with all the incentives and wherewithal : the Brazilian banking sector.

Currently, Brazilian banks offer credit card customers interest free instalment plans. The merchants put their prices up to account for the delay in the receipt of payments. They then factor the credit card receivables with the merchant acquirer in order to get cash.

In the past, when the merchant acquirers were held closely by the banks, the banks would bear the cost of financing on the interest free plans but recoup the losses by factoring the credit card receivables for the merchants. However, the entry of non-affiliated merchant acquirers deprived them of lucrative factoring/prepayment business. Hence, banks are sustaining significant and growing losses in the current constellation of payments and really need to change the game.

There is also another important reason for the banks to react strongly against the market share loss to unaffiliated merchant acquirers. Banks in Brazil are very dependent on profits from SMEs i.e. c. 30 % of overall earnings, whereas the profits from card acquisition are down to 5% of overall profits. The importance of the acquisition business is to provide the link to SMEs to cross sell, at this point the profit motive is secondary and banks have ample room to cross subsidize.

So how exactly are banks fighting back? They have already started offering interest free prepayments. They are also working very hard to change the interest free instalment model while simultaneously creating a market for credit card receivables. Regardless of who acquires the transaction, the merchant can then sell the receivable to the party that offers them the lowest interest rate.

The Brazilian banks system is a largely concentrated and very profitable one that can afford to cross subsidize the small acquirer units in order not to lose out from the much more meaningful SME and consumer lending pie.

The battle royale amongst the banks, bank linked acquirer and unaffiliated acquirers will mean lower MDRs, device prices, prepayment costs and a shorter path to market saturation for POS machines.

The investors behind the unaffiliated merchant acquirers are betting that their companies will not only fend off the bank challenge but also make inroads into stickier software revenues as well as broader lending relationships with merchants. The hefty valuations assigned to these acquirers mean the chance of disappointment is high but one thing is certain. The merchants and consumers will emerge as the winner.